This October 2022 is our last chance to lock in the high yield 9.62% in Series I Bonds because I predict the November rate will be lower.

If you’re looking to offset high inflation in a low risk way, the Series I Savings Bonds are one of the best ways to get a high return in 2022.

You could beat the S&P 500 by a double digit percentage with I Bonds this year as I explain in the video.

I Bonds are also a hedge against inflation as their yields get adjusted with the rate of inflation, so they are especially attractive when we have high inflation.

The 9.62% rate of return is guaranteed for the first 6 months that you own the I Bond, and then it will change after 6 months. The rate could go up or down but you are required to own an I Bond for at least a year.

The rates get set for I Bonds in May and November every year, so the current rate of 9.62% was set in May 2022 and will change in November 2022. The last day to buy I Bonds at the current rate is October 28, 2022 so the final bonds get issued the next business day, Halloween 2022.

The annual purchase limit of each bond is $10,000 per person (so a married couple could get $20,000 total). If you had filed the IRS Form 8888 with your tax return, you could have used your tax refund to purchase $5,000 in paper I Bonds in addition to the $10,000 limit in online I Bonds.

So that’s at least $15,000 I Bonds per person per calendar year. Separately, you could also buy $10,000 of Series EE bonds. You could buy even more I Bonds up to $10,000 per each business, living trust, and child you may have.

If you don’t need $10,000 for the next year, it’s nice to think of I Bonds as part of an emergency fund.

The I Bond has a term of 30 years, and you could own it past that maturity but you won’t earn more interest on it so you might as well cash it by then. If you cash in the bond before 5 years, then you will forfeit the last 3 months’ worth of interest. So to avoid this penalty, ideally own the I Bond for 5-30 years (unless the interest you’re getting is too low, the penalty might not even be a big deal).

I Bonds are zero coupon bonds so you won’t get paid interest throughout the life of the bond, but you get all the interest when you redeem the bond. Bonds are taxed at your ordinary income tax rate at the federal level only, no state or local taxes. You could choose to pay taxes every year or at the end when you get the interest.

If you’re in a 22% income tax bracket and above, you could be paying more in bond interest taxes compared to the 15% in capital gains taxes on stocks.

You would buy I Bonds at treasurydirect.gov, an official US government website that recently had a face lift. But underneath this is still the old school site reminiscent of the early 2000s so don’t be surprised when you log in.

If you’d like to learn how a Series I Bond compares to High Yield Savings, check out this video.

The reason why Series I bonds are almost risk-free are because they’re offered by the US government, which has a pretty strong financial reputation around the world and isn’t likely to go bankrupt anytime soon.

So just like how Warren Buffett likes to get high yields and doesn’t mind where it comes from, I’m also willing to be agnostic of the source of high returns!

The Series I Bond gets its rate from a combination or composite of a couple of factors: 1) a fixed interest rate and 2) an inflation rate.

The fixed rate is currently 0%, and if you buy an I Bond with this fixed rate, that will be the rate for the life of the bond. You can never get less than a 0% return even if we have deflation. This is good and bad because we will never earn negative interest, but getting 0% return isn’t the best either if inflation goes back to a more average 2-3%.

The inflation rate comes from a semiannual inflation rate based on the Consumer Price Index Inflation for All Urban Consumers, All Items (CPI-U). It’s based on a six month period of the change in CPI-U inflation before May and November every year. So the rate that was set in May was based on October 2021 through March 2022, and this November should be based on April 2022 through September 2022.

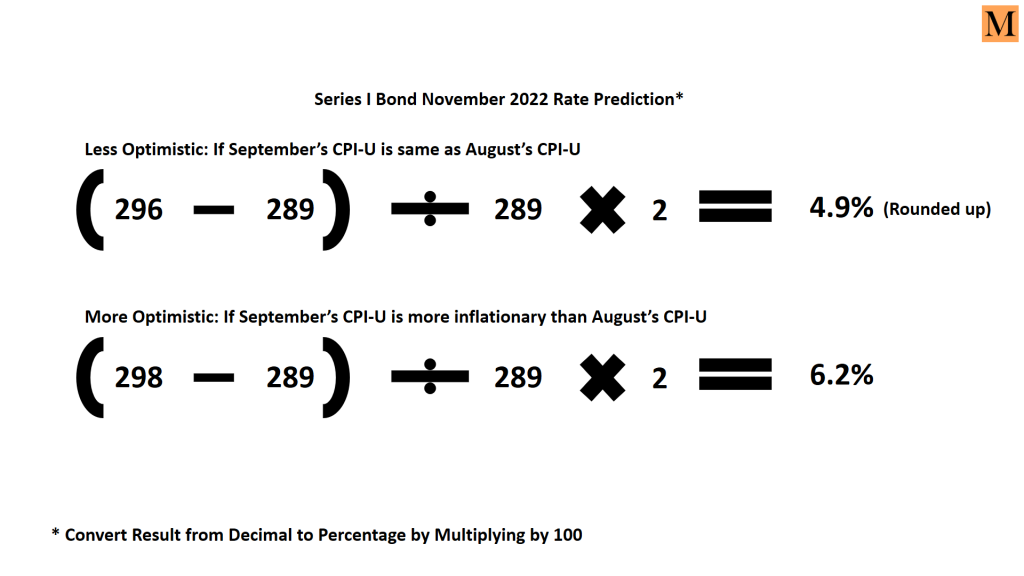

At this time in the I Bond formula, we can ignore the 0% fixed rate parts and focus on multiplying the semiannual inflation rate by 2 to get the I Bond rate.

I’m guessing inflation in September’s CPI-U reading won’t be much more (and could be less with inflation receding) than August’s CPI-U. So if we subtract April’s CPI-U from August’s CPI-U as a September CPI-U proxy and divide over the April CPI-U, we get ((296-289)/289) * 2 (* 100 to get %) = 4.9% rounded up. In a more optimistic I Bond rate if September ends up being more inflationary than August, then that might be a CPI-U of 298 and gives a 6.2% I Bond rate.

This predicted November 2022 I Bond rate range of 4.9% to 6.2% is still below the 9.62% rate right now.

We won’t know what the official September CPI-U figure is until it comes out on October 13 from the Bureau of Labor Statistics. But if it’s anywhere close to my estimates, the future November 2022 rate won’t be as high as it is currently.

Based on these assumptions, the people who did the best were the ones who bought the 7.12% I Bond between November 2021 to April 2022 because if you average that with the 9.62% in the 6 months after, they averaged 8.37%, or just about being in lockstep with August CPI of 8.3% inflation.

If the November 2022 (and May 2023) I Bond rate is lower than 7.12%, we may not be as lucky but we would still do pretty well to get a return between 7.25%-7.9% based on my estimates. Adjusted for inflation we’re still losing a little bit, like around 0.4%-1.05%, but I’ll take that over the stock market’s current inflation adjusted return of -28.77%!

If we redeemed our I Bonds in a year from now, we might give up about 1.5% based on my current estimates. This isn’t too bad in my opinion. Ending up with at least a 5.75% return is still double what most bank accounts are offering.

Sometimes we gotta just take what we can get, like cheaper gasoline prices ($3.05/gallon at the end of September 2022) and a decent bond return rate!

If you’re interested in learning how to take control of your finances and start becoming an investor like Warren Buffett, check out my free PDF guide.

I look forward to making more investor friends! Add me on Insta: michellemarki