Wondering if you’re on track financially?

I’ve heard a good amount of millennials in their early to mid 30s say that they regretted not investing sooner like in their 20s, and now they feel like they will not be able to catch up and become a millionaire someday.

Well, not only is that not true, but actually reaching a million dollars is more than achievable and we’re actually going to have to make it to millionaire status just to have a decent life in retirement. Especially with how wicked high inflation has been (smh).

So what should people in their early to mid 30s be doing financially by now? I share the investing and money goal suggestions that I tell my friends because it’s never too late to start saving and investing!

Have you ever noticed surveys that commonly group people in certain age ranges, like between 25 to 34? The internet has various age groupings where you might be either pleased or displeased to be considered a young adult up to age 39, or another pegs you as middle aged if you’re only 31!

Some people could be feeling like they are in a perpetual state of “arrested development” because according to the Pew Research Center, “a quarter of U.S. adults ages 25 to 34 resided in a multigenerational family household in 2021, up from 9% in 1971.”

That’s a lot of millennials who may be feeling like they are in a state of extended adolescence which is maybe ending by 34 ish. Now millennials are feeling the pressure to move out of the nest and have to really be in the swing of adulthood by their mid 30s. Or not. Up to you. #Adulting

The median salary for the 25-34 cohort is $60K, and increases to $90K for the 45-59 cohort. So lets say that people in their early to mid 30s might be earning $75K on average.

As you reach your 30s, you may be wondering if you’re on track toward your retirement savings goals.

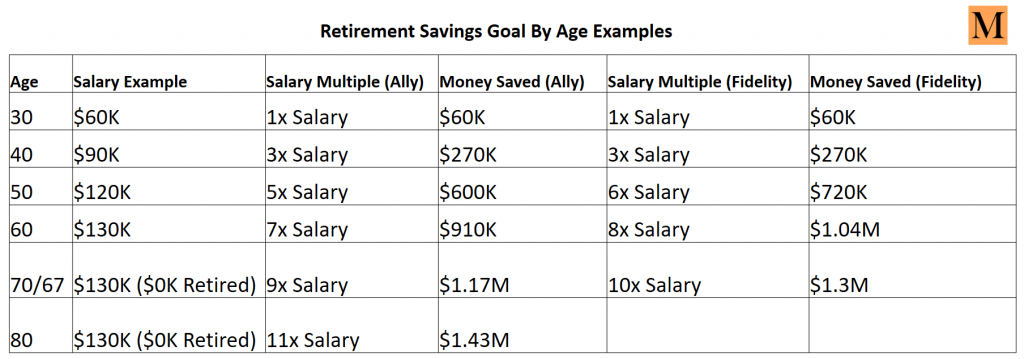

Ally Bank and the brokerage Fidelity shared some ballpark figures of how much you should have saved in terms of salary multiples by each decade starting at 30. They both suggest that at age 30 you should have 1x salary saved and at age 40 you should have 3x salary saved for retirement.

Below I share additional examples for how much we may need to have saved by ages 50 through 80 according to these guidelines.

And lets say you go from having saved $60K by age 30 to saving $270K by age 40, which means you had to save an additional $21K in each year of your 30s to reach that number. This bigger pace of retirement saving is happening at the same time as many people could be raising families during their prime earning years.

According to the Wall Street Journal, it now costs $300,000 to raise a child as of 2022. That’s why they say it’s best to save as much as you can before you have all the obligations that take up a lot of your money and time.

And while some retirement “experts” suggest aiming to have around $1 million in retirement savings, the reality for millennials is we’re likely going to need double this amount — or $2 million!

So if we’re in our early to mid 30s and earning a $75K salary, I think we’re going to need to have saved around $200K by now based on a Nerdwallet retirement calculator to be on track to reach $2 million for retirement by age 67. This calculation assumes that on average, we’re getting a 6% investment return and that inflation is at 3%.

In order to accomplish this financial goal, we’re going to need to push ourselves to earn way more money. And that means we don’t settle for only earning a $60K salary per year, but really earning double that by the time we’re in our 30s — like at least $120K salary per year.

We contribute tremendous value in exchange for productivity gains in the workplace, so I believe we deserve to earn a respectable salary amount so we can have a decent retirement eventually.

Since I am all about do it yourself investing and money management, I don’t necessarily believe in getting a financial planner, but you do you if you feel like you need that extra bit of professional help.

But before you get a financial advisor, make sure you know what their investment track record is like, especially if they’re going to advise you on what stocks, bonds, mutual funds, ETFs, or other assets to invest in.

It’s important that you know what their ability to invest is like, if they’ve been fairly successful or not at investing. They are incentivized to collect fees from you, and their ability to collect fees is not dependent on if you actually do well in your own investments.

As Warren Buffett has said “If [investment] returns are going to be 7 or 8 percent and you’re paying 1 percent for fees, that makes an enormous difference in how much money you’re going to have in retirement.”

This 1% advisor fee could be the difference between ending up with $1.29 million in 40 years at a 7% return rate compared to having less than a million dollars because you forked over 1% in fees with a final 6% return rate.

And because I would love for you and my friends to be as financially successful as possible, I made the following list of my top 15 tips to be on financial track in life:

- Review your assets and liabilities and total them all up. Know what your net worth is.

Make sure any money you have in your checking and savings accounts are earning decent interest rates (at least 1.5% as of summer 2022)! - Learn about investing and contribute to 401k and get the employer match if offered (free money!) (Max it out every year ideally! Up to $20,500 in 2022 if under 50).

- Contribute to Roth IRA if eligible (Max it out every year! Up to $6,000 if under 50).

- Contribute to Health Savings Account (HSA) if eligible with health insurance (Max it out every year of up to $3,650 for self-only and $7,300 for families). (Flexible Spending Account (FSA) is an alternative if no HSA and there’s also an FSA for dependent care).

- Pay off high interest debt and loans (credit cards, student loans, car loans) since 61% of Americans are living paycheck to paycheck in 2022, and while this is down from 78% in 2019, let this fact motivate you. And even if you benefit from student loan forgiveness by the end of this year of up to 10,000 in federal student debt per borrower and up to $20,000 for Pell Grant recipients, let this windfall motivate you to aggressively pay down your remaining debts.

- Automate bill payments as much as possible.

- Emergency Fund of living expenses covered for 3-6 months to a year.

- Optional: Save up for a house down payment (target 20%) and if you already own a house, don’t be in a rush to pay off mortgage if you secured a rate below 5% since high inflation is actually helping you make money while the value of your debt is eroding over time.

- Get all the insurances as you see fit such as life insurance, disability insurance, long term care insurance, etc (sometimes offered through your employer).

- Make sure you have a will and beneficiaries listed on investment accounts.

- Balance your own retirement saving and investing with expecting a family rearing cost of $300,000 to raise each child until 18 and then even more if you pay for some of your kids’ college tuition, room, and board.

- Consider opening a 529 College Savings Program if you have kids.

- If you still have money to allocate, consider investing in stocks or bonds via individual accounts (fully taxable) and custodial investment accounts if you have kids. One example with high inflation is a US Savings Series I Bond with TreasuryDirect currently offering 9.62% interest (guaranteed for 6 months) on up to $10,000 in savings bonds per year.

- Consider starting a business or further enhancing your skills to earn more money and develop some passive income streams.

- Consider helping your parents out in ways that aren’t necessarily financial, especially if they are starting to collect social security and get onto Medicare.

Make sure their wills, health, and home maintenance are up to par.

(In 2022, the average social security benefit was $1,669 per month or $20,028 per year).

If you’re curious like me, you might google “will there be any social security left for millennials?” and the results aren’t super optimistic where we could be losing out on up to $375K by the time we are in our 60s due to social security program reductions by then.

I bring this up not to discourage you, but to motivate you to go out and earn money and do things like check out my “Money Saving Tips: How To Save Money To Become A Millionaire” video so that you don’t have to depend on social security.

Let me know what you think in the video comments, I’d love to hear from you!

If you’re interested in learning how to take control of your finances and start becoming an investor like Warren Buffett, check out my free PDF guide.

I look forward to making more investor friends! Add me on Insta: michellemarki