Ray Dalio and Jeremy Grantham offer advice for how to grow wealth in high inflation and stock markets crashing.

“This is the real McCoy,” observes Jeremy Grantham as we could be seeing stock market declines reaching comparable levels of the dot com bubble bursting in the early 2000s and with rising inflation similar to what we last saw in the 1970s. “We’re in it dudes” as Jeremy thinks we’re in a real stock market crash.

Renowned investors Dalio of Bridgewater Associates and Jeremy Grantham of GMO on May 9, 2022 shared suggestions for how we can not only preserve our wealth, but how we can position our portfolios for growth during this period of high inflation and with financial markets in disarray.

Jeremy Grantham’s investing preferences have evolved from stock markets to resources and climate change-related investing. But he still finds himself enthralled by stock market bubbles so he has dutifully shared his observations and predictions accordingly over the last 40-50 years. Grantham said this is the third greatest investment bubble of his career.

What Jeremy has done during bubble territory, he focuses on the four great bubbles characterized by nearly hysterical behavior, seriously weird over-optimism, which is very rare. And accelerated price moves on the upside and a deviation on the upside between blue chip stocks and risky stocks going down. “That is rare as hens’ teeth,” said Grantham.

He said these bubbles happened in 1929 and 2000 with the growth stocks going down 50% and internet stocks dropped 60-70%. The deviation happened between the S&P 500 rising and the Russell 2000 dropping a lot, a 20-25 point spread on the upside as an indicator of “I gotta keep dancing because the music’s still playing” as a lot of firms have the institutional imperative to keep being invested until they go over the edge.

“They’re not complete idiots,” Jeremy contends, as big funds remain invested in the perceived “safer” stocks compared to the “risky” stocks” which all go down, but maybe the “safer” stocks go down a bit less during bear markets.

Then Ray Dalio said we’re in the part of the typical expansion where there’s a lot of inflation pressures because of aggressive monetary policy creating money and credit leading to debt. Everybody had been long as it was becoming the end of a (market) paradigm because everyone believed things would just keep going up.

This results in a decline of real wealth eventually where “financial wealth” has become enormous relative to the “real wealth” where not everyone will get paid out on their financial claims, such as on corporate debt. As a result, we get negative real returns relative to buying power.

Dalio said, “the expected returns of equities creates a squeeze on equities, changes the economics. A lot of borrowing has been done at much lower interest rates and so on.” And Dalio said, “like all bubbles or paradigm shifts, the mentality that did exist—we don’t have to worry about inflation, cash is a safe place, and so on—gets a shock.”

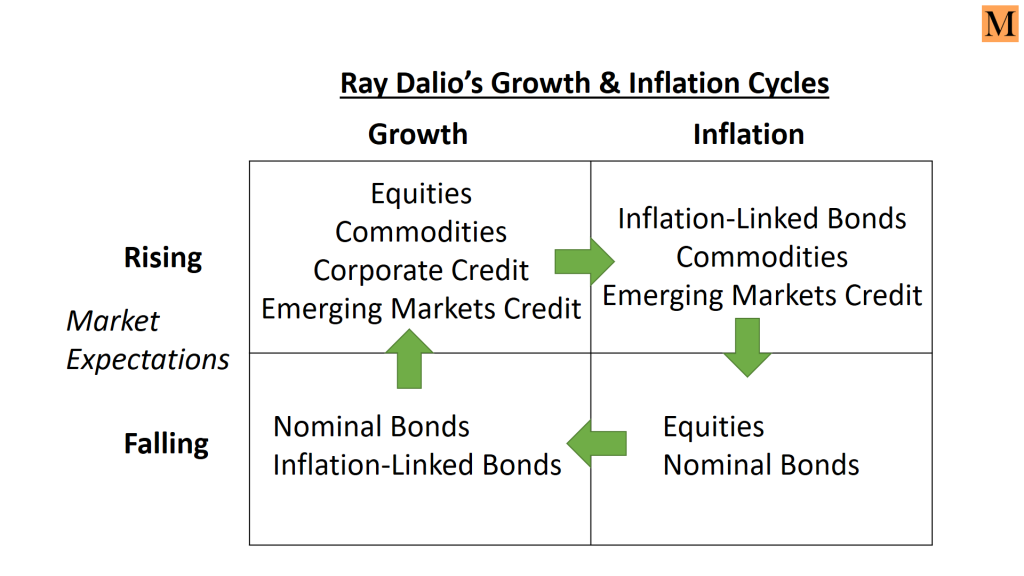

Since Ray Dalio believes that “cash is trash” as he has a matrix of which assets to invest in during cycles of rising and falling growth and inflation.

Dalio said we can simultaneously “reduce risk and raise returns” by allocating more capital toward the upper right quadrant of rising inflation in the following assets: inflation-linked bonds (such as Series I bonds), commodities, and emerging market credit.

We know that Ray Dalio is super bullish on the future of China and India, so there may be attractive investment opportunities in these emerging markets.

Dalio has a suggested “All Weather” or “All Season” portfolio where this strategy involves putting 15% of your wealth split across commodities and gold. You can decide if this makes sense for your portfolio or not.

Some of my key takeaways from these distinguished investors and students of history is per Ray Dalio we could be seeing unpredictable political risk that will have huge economic and social ramifications. And per Jeremy Grantham, we’re seeing declining populations and resource levels due to climate change and high debt risk.

Along with the debt and equity bubbles that are popping, we could see substantial declines as Grantham predicted. In spite of Ray Dalio saying that “cash is trash,” I still like holding onto some cash for optionality like Warren Buffett and Berkshire Hathaway does.

When equities decline some more, and when I think some wonderful companies are available at wonderful prices, then I look forward to investing even more with the expectation that the stock market will recover someday as assets go through Dalio’s inflation and growth cycles.

While we’re currently in rising inflation, eventually we’ll see declining inflation or deflation and then low growth and then we’ll be back to rising growth. I have hope for the future and I hope you do too!

If you’re interested in learning how to take control of your finances and start becoming an investor like Warren Buffett, check out my free PDF guide.

I look forward to making more investor friends! Add me on Instagram: michellemarki