What are fractional shares? I break down what share slices are, how to buy a fraction of a share in a brokerage account, the pros and cons, and comparisons between what brokers offer.

A fractional share is just a unit of stock that amounts to less than one full share.

I use fun food analogies to break down various examples of a fraction of a share of public companies’ stocks.

The ability to directly buy fractional shares came out in November 2019 with Interactive Brokers. Soon thereafter, other brokerage firms like Schwab and Fidelity came out with their own stock slices.

This concept of fractional shares has actually been around for a while, such as when there were stock splits or if you participated in dividend reinvestment program (DRIP). So you might have already ended up with fractional shares in an indirect kind of way before.

When you buy a fractional share, your broker is actually buying whole shares but then is divvying them out to you and others who also want to buy fractions of shares. The broker then holds onto the difference of remaining share fractions or sells them off.

Your share slice gains a proportional amount relative to what a whole share of a stock would return for the year. For example, if Google’s share price went up by 20% in a year, and you bought a $25 slice of Google, your stock slice would appreciate by $5.

I have a pop quiz for you in asking which do you think is more expensive, a $100 share or $10,000 share? And then I explain the answer as we consider the company’s overall valuation/worth and amount of shares outstanding!

I give an example of how we cannot get a share slice of Berkshire Hathaway A shares, but fortunately a sort of fractionalized version, Berkshire B shares, exists at 1/1500 of the A share price!

Using Fidelity, I show an example of if I had only $200 to buy Berkshire B stock, this would get me 0.72 share of a full share of Berkshire B price of $277.60.

As long as your brokerage account allows for share fractions in certain stocks, there are many stocks that we can do this with.

One potential drawback is if the value of our fractional share is too small, then we may forfeit the proportional small amount of dividend if it comes out to less than 1 cent. I show an example of likely missing out on dividends with a $2 share slice of Starbucks.

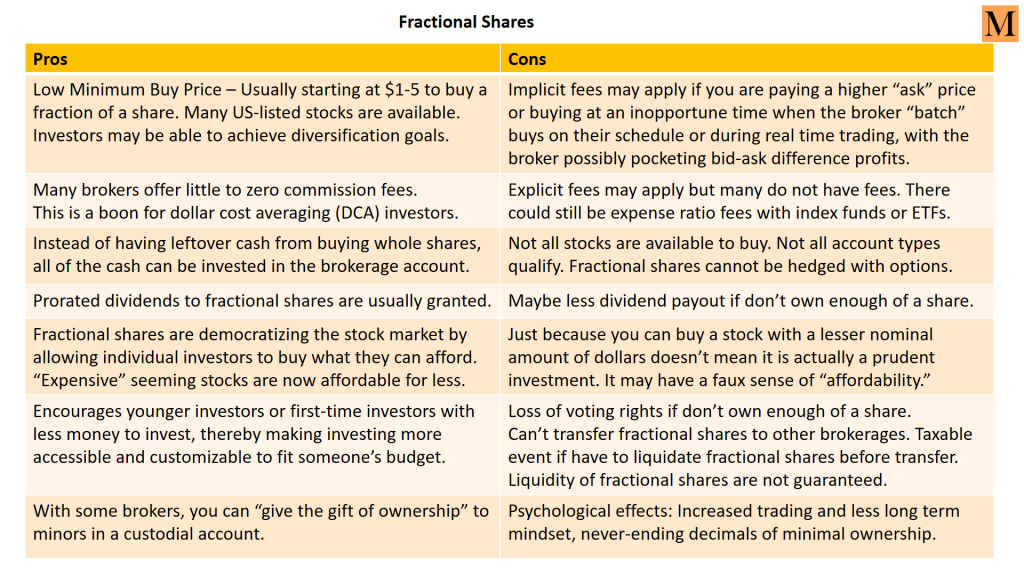

I created a pros and cons table of fractional shares and I discuss what investors should consider before they buy fractions of shares.

Some people are already accustomed to seeing never-ending decimal numbers in other types of alternative assets they may own.

Be sure to shop around for what the different brokerage firms are offering in their fractional share programs if you are interested in this.

There are a few popular sites that compare the offerings across the different brokerages, including number of stocks that participate, minimum purchase amounts (such as $1 or $5), and fees, if applicable.

Who knows if stock slices are the coolest thing since sliced bread? Consider the various options and see what works best for you!

Add me on Instagram: michellemarki! 🙂

If you’re interested in learning how to take control of your finances and start becoming an investor like Warren Buffett, check out my free PDF guide.